Stocks in the Banking Sector Post Resolution 42 - Should Investors Wait or Act?

- Virtus Prosperity

- Jul 17, 2025

- 13 min read

I. Overview of the Banking Sector

1. Year 2024

The loan-to-asset and financial lease ratios as a percentage of total average banking assets reached 65.8% in 2024, indicating significant allocation towards credit activities. Certain banks such as VPBank, BIDV, VietinBank, and Sacombank reported ratios exceeding 72%, reflecting proactive credit growth strategies but also higher risks amidst slow credit demand recovery and tightened lending policies by the State Bank.

The non-performing loan (NPL) ratio on the balance sheet averaged around 1.8–2.0% in 2024. Some banks recorded ratios above 3%, including VPBank, VIB, OCB, SHB, and BVB, primarily due to focus on SME and consumer credit segments heavily impacted by economic downturns. Conversely, Vietcombank, Techcombank, and ACB maintained the lowest NPL ratios under 1.2%, indicating rigorous risk management and high-quality customer portfolios.

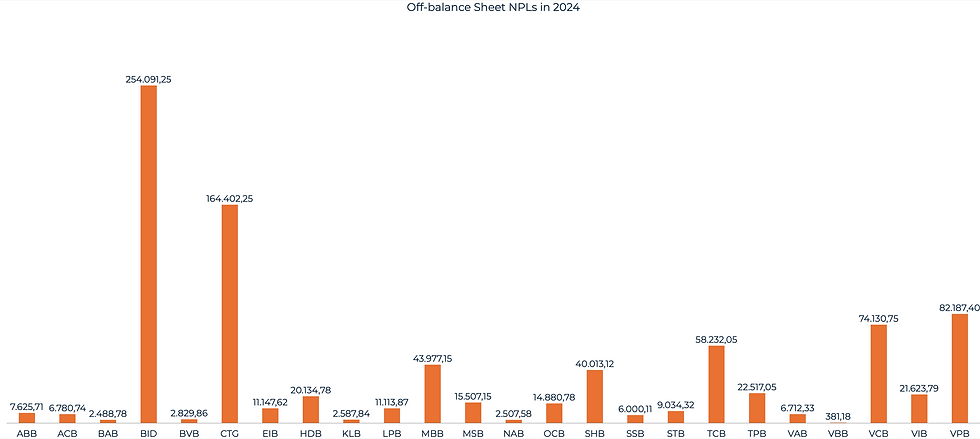

Regarding NPL ratios as a percentage of total assets, the sector's median in 2024 was 1.85%. However, banks like ABB, BVB, SSB, VIB, and notably VPBank reported ratios exceeding 2%, with VPBank leading at 3.15%, highlighting existing credit risks on the balance sheet. Meanwhile, external NPLs (including VAMC bonds, deferred interest losses...) posed a larger challenge, averaging 3.82% of total assets, with BIDV, VPBank, and VietinBank having the highest rates. Notably, BIDV reported the highest external NPL value in the sector, exceeding VND 254 trillion.

The risk provision ratio on outstanding loans across the sector in 2024 stood at 1.53%. State-owned banks like BIDV, VietinBank, Vietcombank, and VPBank continued to lead in provisioning ratios, reflecting robust financial buffer strategies amidst rising NPLs.

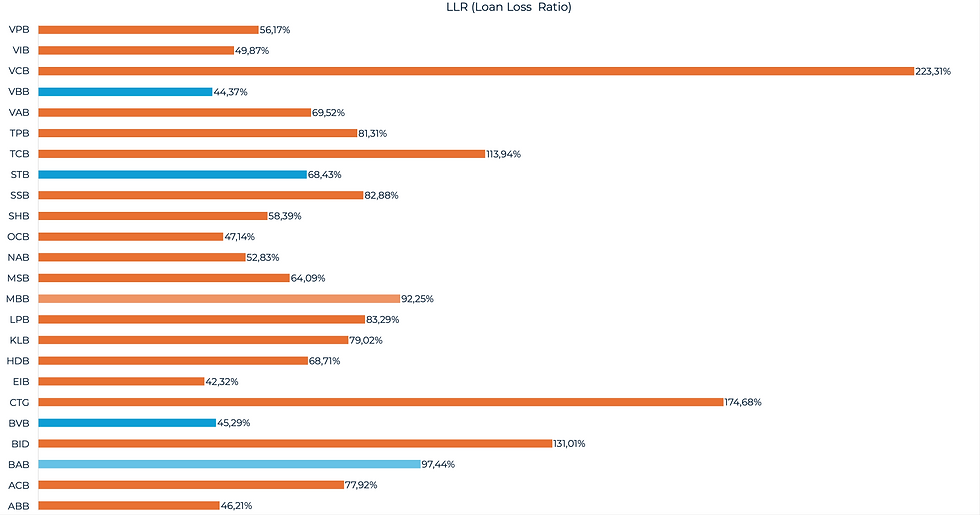

The loan loss reserve coverage ratio (Loan Loss Reserve/NPL) averaged 78.36% across the sector, indicating room for increased provisioning to ensure system safety, especially during synchronized handling of both on-balance sheet and off-balance sheet debts under Resolution 42.

2. Resolution 42

Following the COVID-19 period, bank stocks underwent significant adjustments. Many bank stocks saw declines of up to 40% since early 2022. Market sentiment turned cautious as investors feared "hidden" NPLs off the balance sheet. In reality, the on-balance sheet NPL ratio across the system is currently around 5%, but including hidden NPLs, off-balance sheet debts, and those sold to VAMC, it could approach nearly 6.9% of total outstanding loans. These off-balance sheet debts often create blind spots that make it difficult for investors to accurately assess bank asset quality.

In response, the Government issued Resolution 42/2023/NĐ-CP as a comprehensive effort to address bad debts within the banking system, encompassing both on-balance sheet and "hidden" debts. This initiative builds upon the successes of Resolution 42/2017/QH14, which piloted bad debt management from 2017 to 2022. Thanks to Resolution 42, credit institutions have been able to handle approximately VND 5,800 billion in bad debts monthly – more than 2.5 times higher than before, totaling about VND 444 trillion in bad debts from 2017 to 2023. Resolution 42/2023 aims to provide a stable legal framework for continued effective bad debt resolution, protecting the rights of banks, depositors, and borrowers while reducing provisioning pressures to ensure healthy banking system operations.

In 2024, the dual burden of on-balance sheet and off-balance sheet bad debts continues to weigh heavily on many banks, impacting profitability, capital, and stock valuations.

State-owned banks face significant risks from off-balance sheet debts:

BIDV (BID): Leads with 9.20% of total assets in off-balance sheet debts, while on-balance sheet bad debts account for only 1.05%. This partly reflects debts sold to VAMC or uncollectible guarantees – yet to be fully resolved.

VPBank (VPB): 8.90% off-balance sheet debts, 3.15% on-balance sheet – totaling 12% total asset risk, the highest in the sector. This is a critical issue VPBank must address promptly to restore valuation.

VietinBank (CTG): 6.89% off-balance sheet debts, 0.88% on-balance sheet – risks artificial profitability if deferred interest and hidden off-balance sheet debts are not fully provisioned.

⟶ These leading banks are under significant pressure for increased provisioning.

Banks with higher on-balance sheet bad debts than off-balance sheet debts reflect proactive disclosure or slow processing

MSB, SHB, OCB, ABB, VIB: This group has a higher on-balance sheet NPL ratio compared to off-balance sheet debts. For example:

OCB: 3.17% on-balance sheet vs. 5.30% off-balance sheet.

VIB: 3.52% on-balance sheet vs. 4.38% off-balance sheet.

MSB: 2.68% on-balance sheet vs. 4.84% off-balance sheet

⟶ This indicates many banks have proactively "brought bad debts to light" or have been slow to reduce off-balance sheet debts. Proactive steps show transparency and readiness to face challenges.

The significant variation among banks reflects different levels of progress in bad debt handling and classification strategies, especially under Resolution 42, which mandates thorough identification of hidden risks.

II. Resolution 42/2023: Guidelines for Comprehensive Resolution of On-Balance Sheet and Off-Balance Sheet NPLs

Bad Debt Resolution Process under Resolution 42: Resolution 42/2023/NĐ-CP lays out a systematic roadmap for commercial banks to thoroughly review and resolve non-performing loans (NPLs), including both on-balance sheet and off-balance sheet debts:

Step 1: Review and Reclassify NPLs

Banks must first conduct a thorough review of their outstanding credit portfolio and reclassify debts in accordance with Circular 11/2021/TT-NHNN. Under this regulation, all loans of a customer within a bank must be assigned to the same debt group (Group 1 to Group 5) based on risk level: Group 1 (Standard debt), Group 2 (Special mention debt), Group 3 (Substandard debt), Group 4 (Doubtful debt), Group 5 (Loss). The classification must include both on-balance sheet debts and “hidden” off-balance sheet exposures. Specifically, banks are required to account for: (i) Overdue or irrecoverable debts still recorded on the balance sheet; (ii) Debts sold to VAMC but not yet resolved; (iii) Off-balance sheet contingent liabilities – including uncollected accrued interest, guarantees or credit commitments that have been called upon and moved off the balance sheet due to loss of recoverability. All these debts must be prudently identified and reclassified to prevent underestimation of credit risk.

Step 2: Fully Provision for Credit Risk

Based on debt classification, banks are required to make provisions for each non-performing loan (NPL) according to prescribed rates for each debt group. Specifically, Group 2 debts require a 5% provision, Group 3: 20%, Group 4: 50%, and Group 5: 100% of the loan’s value. In addition, banks must set aside a general provision of 0.75% of the total outstanding loans from Group 1 to Group 4. For off-balance sheet debts, banks assess the recoverability of each item and make provisions similar to on-balance sheet debts with equivalent risk levels. This ensures that even written-off loans are backed by financial buffers in case of potential losses. Notably, Decree 42 mandates transparency in recognizing losses when handling bad debts. If a bank sells an NPL to VAMC or a private AMC at a price lower than the book value, the difference must be recognized as a loss in the current financial period. Banks are not allowed to defer or conceal such losses. This regulation ensures that the cost of bad debt resolution is truthfully reflected, preventing the situation of “illusory profits, real losses.”

Step 3: Apply Appropriate Resolution Measures

Alongside provisioning, banks must implement a series of professional measures to recover and resolve bad debts. The top priority is actively collecting debts from customers – encouraging borrowers to repay voluntarily. In fact, during the pilot implementation of the previous Resolution 42, around 36% of total resolved bad debts were voluntarily paid by customers. If the customer does not cooperate, the bank will proceed to handle collateral. Resolution 42 and the new laws allow banks to seize collateral more conveniently (if the asset is not involved in legal disputes or enforcement), thereby shortening the liquidation process. Banks can conduct public auctions or negotiate the sale of collateral to recover funds. Data from 2024 shows that approximately 46.6% of bad debts were recovered through collateral handling – emphasizing the importance of this approach. In addition, banks may sell bad debts to VAMC or private AMCs (at market prices). This channel proved effective in developing a more active bad debt trading market during 2017–2020. Finally, for truly irrecoverable bad debts, after all measures have been exhausted (debt collection, asset disposal, debt sale...), banks will proceed to write off the debt. Write-offs are only allowed when the debt has been fully provisioned (Group 5) and meets the necessary legal conditions – such as the customer being declared bankrupt, missing, or under court ruling. Writing off the debt allows the bank to remove it from the balance sheet, but the bank must continue to monitor it off the balance sheet.

Step 4: Finalize Resolution and Write Off from Off-Balance Sheet

Once a bad debt has been fully resolved (through recovery or write-off), the bank will reduce the corresponding amount from its off-balance sheet accounts, effectively concluding the debt’s lifecycle. According to Circular 11/2021, after a minimum of 5 years since the provisioning was used to write off the debt and all recovery efforts have failed, the bank may remove the written-off debt from the off-balance sheet. This means the debt is completely removed from the accounting books. However, the bank is still required to retain the records of this written-off debt in its internal management system (off-record) for a long period (possibly up to 10 years) to monitor the possibility of repayment. If recovery occurs after the debt has been written off, the entire recovered amount will be recorded as other income (non-recurring profit). This multi-step process is designed to ensure bad debts are thoroughly handled, the bank’s balance sheet is “cleaned up”, losses are transparently recognized, and banks remain incentivized to maximize recovery efforts even after write-offs.

In summary, Decree 42/2023 establishes a comprehensive framework for the identification, provisioning, resolution, and write-off of bad debts. Compared to the past, its key new point is the expansion of scope to include off-balance sheet debts and accrued interest, requiring full provisioning and thorough resolution. This is considered a “strong dose” that forces the banking system to face and resolve the deeply rooted “blood clot” of outstanding bad debts.

III. Impact on Financial Performance and Bank Stock Valuation

1. Short-term Impact: Increased Provisioning Costs Put Pressure on Profits

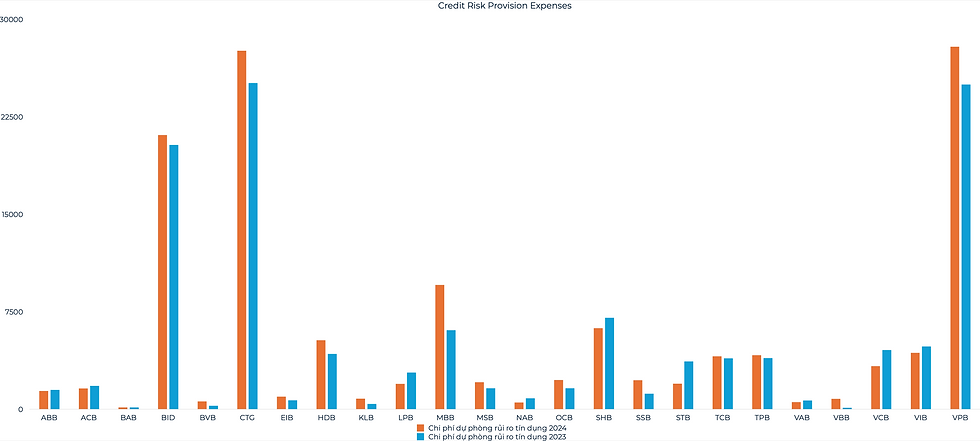

The implementation of Resolution 42 and the aggressive handling of bad debts will undoubtedly place short-term pressure on accounting profits, primarily through a sharp increase in provisioning costs. As banks conduct a more prudent review and reclassification of debts, many loans will be downgraded to riskier groups, thereby requiring higher provisions. Especially, off-balance sheet items that previously did not require provisioning will now be subject to it significantly increasing the bank's credit cost. On average, credit provisioning costs are expected to rise by 40% compared to 2023.

Banks with large accumulated off-balance sheet bad debts and accrued interest will be hit the hardest. For example, VPBank, due to its history of high-risk consumer lending, had around VND 80.187 trillion in resolved but off-balance sheet bad debts by the end of 2024, up 40% from 2023 and equivalent to 8.9% of the parent bank’s total assets. This is a very high figure compared to similarly sized banks (such as TCB, MBB, ACB), suggesting that VPBank will need to take strong provisioning and resolution measures, which will significantly affect short-term profits. Similarly, other banks such as Sacombank (STB) – which previously sold bad debts to VAMC and still holds a large amount of unrecovered debts, and HDBank (HDB) – which has significant accrued interest from consumer finance are also likely to increase provisions sharply. Large amounts of suspended accrued interest will be reviewed and may have to be reversed (i.e., written off from interest income) if deemed unrecoverable, reducing accounting profits during the early quarters of Resolution 42’s implementation. In other words, the process of “cleaning up” financial statements will cause part of previously “unreal” income (due to accrued interest not yet collected or insufficient risk cost recognition) to be corrected into more substantive accounting, but this adjustment process will be reflected in lower reported profits.

While the short-term profit pressure is evident, this does not mean the banking sector is facing real operational difficulties, rather it reflects a more conservative and transparent accounting approach. The core operating income of many banks remains on a positive growth trajectory, which may help offset part of the increase in provisioning costs.

2. Medium- to Long-Term Impact: Improved Asset Quality and Stock Revaluation Potential

If we look beyond the short-term "bottom" of profits, the aggressive handling of bad debts under Resolution 42 may bring fundamental benefits to the banking system, thereby potentially increasing the valuation of bank stocks in the medium to long term. Several key positive aspects include:

a. Benefits for Banks:

- First of all, the balance sheet will become significantly “cleaner” and healthier.

- Chronic non-performing loans (NPLs) being thoroughly resolved will help banks improve their Capital Adequacy Ratio (CAR) and asset quality indicators. As NPLs decline, Risk-Weighted Assets (RWA) also decrease, creating room for safer credit growth or easier Tier 2 capital issuance.

- Improved asset quality also means that management resources are no longer bogged down in dealing with legacy bad debts, allowing banks to focus on more effective new lending.

- Financial transparency is enhanced as accrued interest and large off-balance sheet exposures are cleared. With greater transparency, banks can more easily access international capital sources, for example, by issuing bonds in overseas markets or raising equity from foreign investors.

- Credit ratings may improve as rating agencies assess stronger risk control over NPLs. Another benefit is reduced cost and time for future legal proceedings. Once legacy bad debts are cleared, any newly emerging NPLs can be handled more efficiently under standard procedures, avoiding prolonged litigation.

=> The codification of Resolution 42 helps restore collateral repossession rights, accelerate bad debt recovery, and improve bank profitability, especially as the real estate market is forecasted to rebound in 2025.

Equally important, the thicker provision buffer following the resolution cycle becomes a valuable “reserve” for banks in the future. The sector-wide Loan Loss Reserve (LLR) coverage ratio rose to approximately 78.36% by the end of 2024. Several major banks have substantial buffers: Vietcombank (VCB) maintains an LLR of ~223% (i.e., provisions covering 2.23 times its NPLs), VietinBank (CTG) ~174%, BIDV (BID) ~131%, and Techcombank (TCB) ~113%. Banks with early and adequate provisioning will be less impacted when Circular 02 expires (when restructured loans must be reclassified). Conversely, banks with thin provisions will face higher provisioning costs, but will eventually reach a safer baseline.

In the long run, a high LLR enhances banks’ resilience against economic shocks. In fact, the market already factors in the size of these buffers into stock valuations, banks with stronger provisions tend to be valued higher due to lower perceived risk. Therefore, the current provisioning cycle can be seen as "a step back to move two steps forward": banks accept lower profits now in exchange for stronger fundamentals, paving the way for sustainable growth and a future re-rating in valuations.

b. Benefits for bank equity investors:

- For shareholders and investors, a “cleaned-up” balance sheet provides a clearer financial picture, enabling bank stocks to be more accurately valued. Previously, many investors were wary of bank stocks due to the difficulty in measuring hidden risks from large off-balance sheet items or accrued interest. Once these “risk metrics” are dealt with and disclosed transparently, investors can more easily assess the bank’s actual earnings instead of being clouded by uncollected interest or hidden NPLs. As a result, banks previously discounted by the market for bad debt exposure will have the opportunity for a positive re-rating.

- In practice, after each past NPL resolution cycle, bank stocks often entered a new growth phase once profitability recovered on a cleaner foundation. For example, during 2017–2019, many bank stocks rose sharply as legacy NPLs and VAMC bonds were resolved.

- It is expected that banking stocks will become more differentiated: banks that “clean house” and maintain strong fundamentals will likely outperform the rest of the sector.

- Another notable point: as off-balance sheet NPLs are recovered, income from previously written-off loans will significantly contribute to profits. ⇒ It is estimated that other income from NPL recovery at banks with large off-balance sheet exposures (such as VPBank, SHB…) may increase strongly from 2025–2026.

- For instance, VPBank may recover VND 80 trillion in off-balance sheet debts faster, making a significant contribution to future profits. Therefore, investors who buy bank stocks in the current period may expect to “reap the rewards” in the medium term as one-off profits from NPL recovery are booked, boosting return on equity.

c. Positive impacts on credit activity and interest income: In parallel with reduced risk, thorough NPL resolution also paves the way for real credit growth in the future

- First, once NPLs are recovered or written off, banks can free up credit limits that were previously “tied up” in legacy bad debts. “Dead” assets are converted into cash and can be re-lent. Moreover, the State Bank of Vietnam also considers asset quality when assigning credit growth quotas, cleaner banks with fewer NPLs typically receive higher credit room due to lower risk. Thus, banks that finish resolving NPLs in 2023–2024 will have more room for credit expansion in 2025–2026, aligning with the recovery in capital demand across the economy.

- Second, transitioning from non-performing, non-interest-earning assets to interest-earning loans improves Net Interest Margin (NIM). Instead of provisioning for non-income-generating legacy loans, banks can lend out those funds at interest, thereby increasing net interest income. Some banks report that after resolving Covid-restructured loans, they have been able to recover previously reversed accrued interest as customers resume payments, also contributing to stronger interest income.

- Third, reduced opportunity cost and administrative burden in managing NPLs improve overall operational efficiency, potentially lowering the cost-to-income ratio (CIR). Overall, in the medium term, banks’ cash flows and actual profitability will be stronger than during the NPL-heavy phase, which in turn supports a rising trajectory for stock prices.

V. Conclusion

The legalization of Decree 42/2023/NĐ-CP represents a significant advancement in Vietnam's efforts to comprehensively resolve non-performing loans (NPLs) within the banking system. Unlike previous initiatives that only focused on on-balance sheet loans or were merely pilot programs, this regulation expands the scope to include off-balance sheet “hidden” debts, compelling banks to confront and resolve long-standing issues at their root. While this may cause short-term pain in the form of higher provisioning costs and lower accounting profits, it lays a more solid foundation for the banking sector in the long run. With cleaner balance sheets and more robust actual capital, banks will be better positioned to extend new credit and support economic growth without being constrained by legacy "blood clots" in their portfolios. A clear market differentiation is expected: banks that act proactively and transparently in resolving NPLs will recover profitability and break through early, while laggards may be left behind.

For investors, it's crucial not to generalize across the entire sector. This is a time that calls for careful selection. Current profit figures may not accurately reflect the underlying "health" of each bank, a deeper analysis of asset quality and progress in NPL resolution is essential. A smart approach is to closely monitor how each bank implements Decree 42 and assess how effectively they are “cleaning up” their balance sheets. Once a bank is seen to have fundamentally addressed its NPL issues and is ready for a new growth cycle, that will likely be the point at which its stock valuation aligns more closely with its true strength.

Heading into 2025–2026, bank stock valuations are expected to more accurately reflect true asset quality and each bank’s risk management capabilities. Banks that perform well in this “stress test” will rise to lead the market and deliver substantial returns to shareholders, mirroring the prosperity seen in past post-cleanup cycles. Following this major test, Vietnam’s banking sector is poised to turn the page to a new chapter: safer, more transparent, and more sustainably developed, reaffirming its backbone role in the economy.

Comments