Vietnam’s Digital Asset Market in 2026 - A New Dawn with Global Partnerships

- Virtus Prosperity

- 3 days ago

- 17 min read

I. Introduction

Vietnam’s Digital Asset Market on the Rise: In 2026, Vietnam stands on the cusp of a financial revolution. The country is transforming from a crypto grey zone into a regulated digital asset market, fueled by forward-looking policies and groundbreaking partnerships.

A landmark event occurred in mid-2025 when Military Bank (MB) – one of Vietnam’s leading banks – signed a memorandum of understanding (MOU) with Dunamu Inc., the South Korean fintech powerhouse behind the Upbit crypto exchange. This partnership aims to establish Vietnam’s first official “sàn giao dịch tài sản số” (digital asset exchange).

Under the agreement, Dunamu will serve as MB’s strategic technology partner, sharing its world-class exchange infrastructure and advising on regulatory compliance. The MOU symbolizes Vietnam’s intent to develop a robust crypto marketplace, positioning the nation as an emerging player in the digital economy.

Regulatory Green Light: This ambitious drive is underpinned by new legislation.

In June 2025, Vietnam’s National Assembly passed the Law on Digital Technology Industry, which for the first time legally recognizes crypto assets as a form of digital property (distinct from securities or fiat currency). The law, effective January 1, 2026, provides a legal foundation for digital asset creation, trading, ownership, and services – including exchanges – along with measures for security and anti-money laundering. It represents a sweeping policy shift after years of ambiguity.

Prime Minister Phạm Minh Chính has actively championed this change, urging swift development of a legal framework and a pilot digital asset market. By late July 2025, he announced that Vietnam was “building a legal framework and preparing to launch a pilot digital asset market in the near future”, assigning the Ministry of Finance to draft detailed regulations.

The pilot program, now being finalized, envisions licensing multiple exchanges under a tightly controlled framework to ensure competition and innovation while maintaining oversight.

=> If approved by top leadership, a government resolution could roll out the pilot as early as late 2025, paving the way for one or more exchanges (like the MB-Dunamu venture) to begin operations in 2026.

Why 2026 Is a Turning Point: Several forces have converged to make this the moment for Vietnam’s crypto leap.

For one, Vietnamese people have shown remarkable enthusiasm for cryptocurrency despite the past lack of regulation. According to industry data, over 17 million Vietnamese (about 17% of the population) own crypto assets, placing Vietnam among the top countries globally in crypto adoption.

In fact, Vietnam ranked fifth worldwide in Chainalysis’s recent crypto adoption index, reflecting a high grassroots uptake of digital currencies. This popularity is driven by a young, tech-savvy population and a vibrant community of blockchain developers and investors.

However, until now these activities operated in a legal grey area – crypto trading was neither officially allowed nor protected, with the central bank forbidding financial institutions from touching cryptocurrencies.

By embracing a regulated market, Vietnam aims to harness this latent demand and innovation into a formal sector that can be supervised and taxed, rather than pushing it underground.

As the Prime Minister noted, the goal is to “balance regulatory oversight, including tax management, while fostering growth” in the crypto sector.

II. Global Giants Behind Digital Asset Exchanges: Tech and Trust

Vietnam’s foray is greatly strengthened by the involvement of established global players.

Digital asset exchanges are complex platforms requiring cutting-edge technology, liquidity management, cybersecurity, and regulatory expertise.

Around the world and across Asia, many of the most successful exchanges are backed by powerful companies or conglomerates that provide this vital technology and infrastructure backbone. By teaming up with Dunamu – operator of Korea’s Upbit exchange – Vietnam is effectively importing a proven exchange engine and know-how honed in a mature market.

Dunamu is South Korea’s largest centralized crypto exchange operator and the world’s third-largest by trading volume. Upbit, its flagship platform, handles roughly 80% of South Korea’s crypto trading and serves over 6 million users, with a staggering $1.1 trillion in trading volume in 2024 and over $80 billion in digital assets under custody . These numbers underscore an infrastructure built for massive scale.

Under the MOU, Dunamu will share its exchange technology, infrastructure, and security systems with MB, effectively jump-starting Vietnam’s exchange with battle-tested systems.

It will also advise on operations and compliance – invaluable given Dunamu’s experience navigating Korea’s strict regulatory environment. This kind of partnership gives Vietnam’s first exchange instant credibility. “Dunamu is committed to sharing its expertise and providing the best solutions with safety and transparency, thereby attracting both domestic and international investors,” said Vice Chairman Kim Hyoung-nyon of Dunamu.

=> In other words, a world-class engine will power Vietnam’s crypto marketplace from day one.

Vietnam’s strategy mirrors a broader trend: the biggest digital asset exchanges often have big-name backers ensuring their reliability. Some major exchanges and the companies behind them:

Upbit (South Korea) – Operated by Dunamu Inc. (fintech firm partly backed by Kakao and other investors). Upbit leveraged Korea’s pro-innovation yet tightly regulated regime to dominate the market. Dunamu’s tech strength and compliance rigor made Upbit a trusted household name, now expanding abroad. Dunamu’s success in Korea – achieving 80% market share – is exactly the expertise it brings to Vietnam.

Binance (Global) – Founded by entrepreneur Changpeng Zhao, Binance grew explosively to become the world’s largest crypto exchange. It has no single corporate parent but has benefited from strong leadership and an early-mover advantage. As of mid-2025, Binance handles about 40% of all global spot crypto trading – nearly $700 billion in volume in a single month (July 2025) . Such scale is supported by a vast international infrastructure and sophisticated matching engine. However, Binance’s trajectory also shows the challenges of operating without a home base – it now faces regulatory crackdowns in several countries. This highlights why partnering with a regulated entity (like MB) and operating under clear local laws, as Vietnam is doing, can be beneficial for long-term stability.

Coinbase (USA) – Backed by major venture capital firms and now publicly listed on NASDAQ, Coinbase is known for its compliance and secure infrastructure. It became the first crypto exchange to IPO, reflecting investor confidence in its governance. Coinbase’s trading volumes (around 5–7% of global market share in 2025) are smaller than Binance’s, partly due to the stricter U.S. market, but its brand is synonymous with trust and institutional adoption. Its journey shows how regulatory clarity (in Coinbase’s case, U.S. securities laws and oversight) can help integrate crypto into mainstream finance – a lesson not lost on Vietnam’s policymakers.

Bitkub (Thailand) – A Thai-founded exchange that rode a wave of retail crypto enthusiasm, capturing the majority of Thailand’s domestic crypto trades by 2021. Bitkub’s rapid rise drew interest from traditional finance – in 2021, Thailand’s oldest bank SCB agreed to acquire 51% of Bitkub for 17.85 billion baht (~$500 million), valuing the startup near $1 billion. This would have made Bitkub a bank-affiliated exchange, marrying tech innovation with banking credibility. Although the deal was later scrapped due to regulatory issues (Thai regulators flagged concerns over one of Bitkub’s listed tokens and other compliance gaps) , the episode is instructive. It shows that big financial institutions see tremendous value in digital asset platforms, but also that robust governance and risk controls are non-negotiable for such partnerships. Vietnam appears to be heeding this lesson by setting strict criteria for exchange licensing (on operational, financial, and security standards) and keeping regulators closely involved from the start.

DBS Digital Exchange (Singapore) – Even conservative banks are launching exchanges under the right conditions. In December 2020, DBS Bank (Singapore’s largest bank) became the first bank in Asia to launch its own cryptocurrency exchange. The DBS Digital Exchange (DDEx) offers trading of Bitcoin, Ether and other assets to institutional and accredited investors, leveraging the bank’s enterprise-grade security and custody solutions. Backed by decades of banking experience, DDEx illustrates how regulated institutions can successfully integrate crypto into their services. Singapore’s clear licensing framework enabled DBS to do this, highlighting the importance of a supportive regulatory environment. Similarly, Vietnam’s MB Bank, with its strong reputation, is stepping forward to integrate crypto trading into Vietnam’s banking ecosystem – in collaboration with Dunamu – once a legal framework is in place.

Others in Asia – There are numerous other examples:

Huobi, once one of China’s “Big Three” exchanges, relocated to Singapore and now operates globally (recently rebranded as HTX) with backing from global investors.

OKX (originating from China) moved to more crypto-friendly jurisdictions and built a large platform catering to Asia and beyond.

In Japan, mainstream financial giants like SBI Holdings have launched or acquired crypto exchanges (e.g., TaoTao) under the country’s strict licensing regime, ensuring technology and security are on par with traditional stock exchanges.

In Indonesia, the largest exchanges like Indodax began as local startups but aligned with government initiatives (as we’ll see, Indonesia even created a national exchange).

And in the Philippines, fintech firms like Coins.ph and licensed platforms like PDAX have partnered with banks or were invested in by global crypto companies, blending local market knowledge with international tech.

Scale and Technology: The common thread is that strong technology infrastructure and deep liquidity pools are essential for an exchange’s success. Whether it’s Binance’s matching engine handling tens of thousands of trades per second, or Upbit’s wallets securing billions in customer assets, the back-end systems must be resilient and secure. These systems are often built by teams with years of experience in fintech or global markets.

By aligning with Dunamu, Vietnam’s upcoming exchange gains an immediate advantage in this area. Dunamu’s platform has been refined in one of the world’s most demanding markets (South Korea) with:

High standards of security (to fend off hacks)

Low latency trading

Compliance with know-your-customer (KYC)

Anti-money-laundering (AML) rules.

=> In short, Vietnam doesn’t have to reinvent the wheel – it is importing a ready-made high-performance engine.

Likewise, other global players are contributing to Vietnam’s crypto infrastructure.

For instance, earlier in 2025 the Ministry of Finance engaged Bybit, a top-tier international crypto exchange, to provide technical assistance for a prototype trading platform. Bybit’s CEO Ben Zhou advised on using a sandbox environment to test trading features and AML systems before full launch . He highlighted Bybit’s expertise in anti-money laundering technology and security, which Vietnam can leverage to build a safe exchange.

(Bybit itself faced a large cyberattack in the past and learned hard lessons, reinforcing its security – Zhou noted a $1.5 billion hack attempt and the exchange’s commitment to reimburse users and collaborate with authorities . Such transparency and resilience are qualities Vietnam will demand from its exchange operators.)

=> Vietnam’s digital asset exchanges will stand on the shoulders of giants. Companies like Dunamu (Upbit), and contributions from others like Bybit or Hana Financial (a major Korean bank partnering via MB), infuse the venture with technical excellence, operational know-how, and investor confidence.

=> This dramatically increases the chances that Vietnam’s first exchanges will be reliable and competitive from the start – capable of handling large volumes and warding off security threats. For investors and the general public, seeing respected international firms behind the platforms will also instill trust. A crypto market is only as strong as the trust in its infrastructure, and Vietnam is wisely borrowing that trust from those who have earned it globally.

III. Southeast Asia’s Crypto Landscape: Lessons for Vietnam

Vietnam is not entering the crypto market in isolation – it’s part of a dynamic Southeast Asian region where digital assets have surged in popularity, prompting varied responses from governments.

By examining how neighboring countries handle crypto exchanges, Vietnam can glean valuable lessons on what opportunities to seize and what pitfalls to avoid. Let’s compare several key regional players:

Indonesia – A Government-Led Exchange:

Indonesia took a unique approach by launching a national crypto asset exchange and clearing house in July 2023, with direct government oversight . The aim was to provide regulators with transaction records and better protect investors, especially after crypto investors in Indonesia ballooned to 17.5 million people (more than the number of stock market investors) by mid-2023.

Under Indonesia’s model, all crypto trades will eventually funnel through this national exchange (run by a state-appointed operator) and a state clearinghouse, ensuring transparency.

Indonesia still bans crypto as a means of payment (as Vietnam does), but fully allows it as an investment commodity . The Indonesian government’s heavy involvement shows a protective stance: it wants the benefits of crypto investment but under its watchful eye.

=> The Indonesian case also highlights demand: if a country with a comparable population has ~17 million crypto investors, Vietnam’s own high adoption is credible and a large potential market to serve.

Thailand – Booming Market Meets Strict Regulation:

Thailand was one of the first in Southeast Asia to regulate crypto exchanges (issuing licenses since 2018). Thai investors enthusiastically embraced crypto – by 2021, daily trading volumes on local exchanges often rivaled stock exchange volumes.

Bitkub, as mentioned, became a domestic giant. This boom was enabled by a clear legal framework (exchanges must be licensed by the Securities and Exchange Commission of Thailand and comply with investor protection rules).

However, Thailand’s experience also shows regulation must keep pace with innovation. The Thai SEC had to crack down on issues like exchanges listing risky tokens or outages during volatile periods.

=> The aborted SCB-Bitkub acquisition in 2022 underscored regulatory rigor: the deal fell apart because authorities ordered Bitkub to fix problems (like the opaque listing of its own KUB coin) before any takeover.

Furthermore, in 2022-2023 Thailand tightened rules, banning crypto use for payments and heavily scrutinizing advertising and custody practices after some global debacles.

=> By setting the bar high initially, Vietnam can avoid painful corrections later. Thailand’s case also suggests that having traditional banks involved (SCB in Bitkub, or MB in Vietnam’s exchange) can enhance oversight since banks are experienced in compliance – but only if the exchange itself adheres to the law. Vietnam’s decision to involve a reputable bank like MB from the outset could help maintain credibility and discipline.

Singapore – A Fintech and Crypto Hub: Singapore stands out as a regional fintech hub that is pro-innovation yet very disciplined in regulation.

The Monetary Authority of Singapore (MAS) introduced a licensing regime under the Payment Services Act, requiring crypto exchanges to meet standards on AML, technology risk, and consumer protection.

Many global crypto companies flocked to Singapore for its clear rules and tech-friendly environment. Crypto.com, Coinbase, DBS’s DDEx, and others obtained licenses or in-principle approvals to operate in Singapore, making the city-state a center for legitimate crypto activity in Asia.

Singapore’s approach illustrates the benefit of clarity: by explicitly legalizing and supervising exchanges, it attracted massive investments and talent, while minimizing grey-market activity.

However, Singapore also learned from incidents like the collapse of FTX (the global exchange that had a regional HQ in Singapore) and the failure of some large crypto funds (Three Arrows Capital) that were based there. => In response, MAS further tightened retail investor protections – for example, disallowing crypto advertisements targeting the general public and requiring risk warnings on crypto platforms.

=> Vietnam similarly is legalizing exchanges but will likely restrict certain high-risk activities at first (perhaps limiting leverage trading, or requiring investor education).

Philippines – Financial Inclusion via Crypto: The Philippines has a large unbanked population and high overseas remittances, conditions in which crypto can thrive as a low-cost transfer and investment tool.

The central bank of the Philippines (BSP) created a Virtual Asset Service Provider (VASP) license for exchanges. As of 2022, a number of exchanges obtained this license, including foreign-linked ones like Coins.ph and local players like PDAX. The BSP even put a temporary moratorium on new licenses to carefully assess the industry.

Notably, UnionBank of the Philippines became the first major bank there to launch crypto trading services: by late 2022, UnionBank received approval and introduced a feature allowing users to buy/sell Bitcoin within its mobile banking app. This move by a traditional bank signaled that crypto is entering the mainstream in the Philippines, with regulators’ blessing.

=> The Philippine experience suggests crypto can complement financial inclusion, providing people alternative investment and payment channels. It also shows the value of banks getting involved to bridge trust for customers new to crypto. Vietnam, with its high internet and mobile payment usage, could similarly leverage crypto to advance financial inclusion and digital banking offerings.

=> We may soon see Vietnamese fintech apps (perhaps even MB’s own app) allowing customers to dabble in digital assets, once the exchange infrastructure is in place.

Malaysia:

Malaysia permits crypto exchange operation under the Securities Commission’s oversight – the largest platform there is Luno, which operates with full authorization and is owned by a global Digital Currency Group.

Malaysia’s approach has been cautious, focusing on a few licensed exchanges and investor education.

=> Southeast Asia offers both inspiration and caution. The region’s high crypto adoption (with Vietnam, Thailand, Philippines consistently ranking near the top globally) means the opportunity is huge – a young investor base eager for digital assets. But the experiences of neighbors teach Vietnam the importance of clear laws, strong oversight, industry collaboration with authorities, and public education.

=> By implementing its pilot in a methodical way, Vietnam is positioning itself to join the likes of Singapore as a reputable crypto-friendly jurisdiction, while avoiding the missteps that lead to scandals or investor harm. The stage is set for Vietnam to possibly leapfrog – learning from others’ lessons to build a crypto market that is both dynamic and trustworthy.

Opportunities for Vietnam: A New Fintech Frontier

Unlocking a Digital Economy Boost: Embracing digital assets could significantly contribute to Vietnam’s burgeoning digital economy. By legalizing crypto exchanges, Vietnam can attract capital inflows and tech investments that fuel innovation. Global crypto companies see Vietnam as a high-potential market – for instance, Tether (issuer of the USDT stablecoin) has called Vietnam a “critical part” of its long-term vision and is excited to support Vietnam’s blockchain development.

New Funding Avenues for Businesses and Startups: A domestic digital asset exchange would create an alternative fundraising platform for Vietnamese startups and projects. Just as companies list on stock exchanges to raise capital, blockchain projects could issue tokens and list them on the Vietnamese exchange (subject to regulations). This offers local startups access to international investors and liquidity without needing to go abroad. As noted by Vietnam’s Investment Review, a regulated virtual asset exchange could “provide a platform for domestic blockchain projects to access international markets, potentially increasing foreign currency earnings”.

Attracting Foreign Investment and Partnerships: Vietnam’s large, youthful population and growing middle class make it very attractive to crypto businesses. By establishing clear rules, Vietnam is sending a signal to the world: “We are open for crypto business – legitimately.” This regulatory certainty will entice institutional investors and reputable crypto firms to enter the market. In fact, Binance in 2023 launched a “Blockchain for Vietnam” initiative and indicated Vietnam is a crucial link in its global strategy . With the law in place, such initiatives can progress from MoUs to concrete operations. Vietnam could potentially become a regional hub where exchanges set up local branches, venture capital funds pour money into crypto startups, and blockchain conventions and hackathons take place (showcasing Vietnam as a rising star in crypto). This also aligns with Vietnam’s strategic partnership with South Korea – deepening economic ties through fintech collaboration.

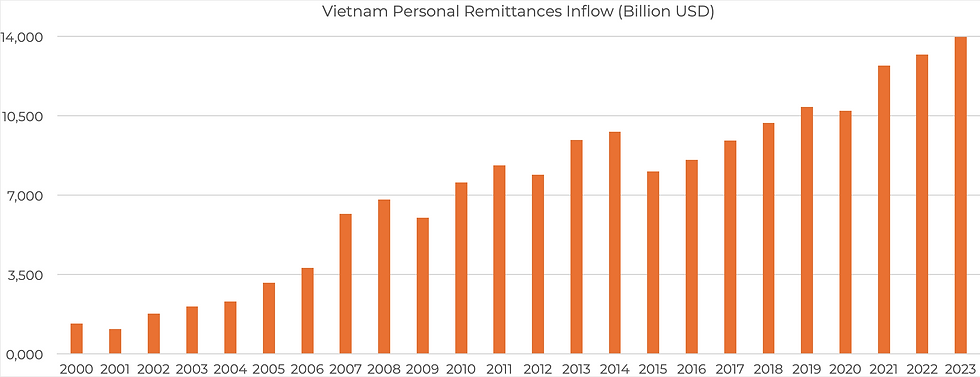

Financial Inclusion and Remittances: Vietnam is known for its high remittance inflows (Vietnamese overseas send tens of billions of dollars home annually). Crypto can offer faster and cheaper remittance channels via stablecoins or Bitcoin, particularly if there’s a trustworthy local exchange to convert crypto to Vietnamese đồng seamlessly. Moreover, a digital asset exchange can serve populations that traditional finance under-serves. Vietnam’s banking penetration has grown, but many still find investing in stocks or other assets complicated. By legitimizing crypto, Vietnam can further empower freelancers and entrepreneurs to transact globally. A regulated exchange ensures they can convert earnings to fiat safely, encouraging more people to participate in the digital economy.

Job Creation and Skill Development: The establishment of crypto exchanges and related services will create new high-tech jobs in Vietnam – from blockchain developers and compliance officers to customer support and digital marketers specialized in crypto. The industry will need local talent, and partnerships with firms like Dunamu include plans for workforce training and knowledge transfer to Vietnamese professionals . Over time, Vietnam can cultivate a skilled talent pool in blockchain tech and fintech. This workforce not only serves the domestic market but could also be in demand regionally (making Vietnam a net exporter of skilled tech labour). The ancillary sectors will benefit too – legal firms will develop crypto law expertise, consultancies will advise on blockchain projects, and so on. It’s an opportunity for Vietnam to position its human capital for the jobs of the future.

Integration with Global Financial Networks: Having a regulated exchange can enable Vietnam to integrate with the emerging global digital asset infrastructure. Vietnamese đồng-backed stablecoins might emerge (perhaps issued by banks or tech firms) and list on the exchange, facilitating digital payments while adhering to monetary rules. Vietnam could also explore launching CBDC (central bank digital currency) pilots in the future that interact with these exchanges, as a number of countries are doing. Being part of the crypto financial network means Vietnamese businesses and developers can more readily participate in global markets, whether it’s decentralized finance (DeFi) or cross-border trade using blockchain. In essence, Vietnam can leap into the Web3 economy and not be left behind as the world transitions toward blockchain-based systems.

Tourism and Soft Power: Interestingly, a thriving crypto sector could attract crypto tourism or digital nomads to Vietnam. Places like Bali and Thailand have seen influxes of crypto entrepreneurs and remote workers drawn by a crypto-friendly environment. Vietnam, with its affordable living and tech scene, could do the same. This brings diverse talent and spending into the country. Additionally, if Vietnamese projects start succeeding internationally (like the way Axie Infinity, a Vietnamese-developed blockchain game, made global headlines), it boosts Vietnam’s image as a tech innovator on the world stage.

=> Vietnam stands to gain economically, technologically, and socially from developing its digital asset market. As long as these opportunities are nurtured within a sound regulatory framework, the upside is immense. Vietnam could transform into a regional center of excellence for blockchain, much as it did in the past for manufacturing or, more recently, IT outsourcing. The combination of a huge domestic user base and now a supportive policy means Vietnam can leverage both local and international resources to turbocharge its digital finance sector.

IV. Vietnam’s Crypto Horizon: Looking Ahead to 2026 and Beyond

As 2026 unfolds, Vietnam finds itself at the threshold of a digital finance renaissance. The pieces are rapidly falling into place: a supportive legal framework, enthusiastic local demand, and partnerships with world-class crypto companies.

The MOU between MB Bank and Dunamu – once just a headline – is now transforming into concrete action, with teams likely working on building the exchange’s infrastructure, integrating Upbit’s technology, and ensuring compliance with Vietnamese regulations.

By late 2025 or early 2026, we may witness the launch of Vietnam’s first homegrown digital asset trading platform, an event that will be historic for the country’s financial sector. It will signify Vietnam’s emergence from the sidelines into the forefront of the crypto economy.

The potential impacts are profound. Vietnam stands to become a leader in Southeast Asia’s digital asset space, leveraging its high adoption rates and now a regulatory green light. Especially with Dunamu’s Upbit connection – Upbit already operates successfully in Korea, and has expanded to other countries like Thailand and Indonesia via franchise models. A Vietnam Upbit (under MB’s branding) could integrate into Upbit’s global liquidity network, meaning Vietnamese traders benefit from deeper markets and vice versa. The MOU hints at this regional vision, placing Vietnam firmly on the global crypto map.

Moreover, the Vietnamese government’s proactive stance indicates that more supportive policies might follow. We could see the introduction of tax incentives for blockchain startups, sandboxes for other crypto-related innovations (like insurance, DeFi, or digital bonds), and integration of blockchain in e-government services. Vietnam’s National Strategy for Blockchain by 2030 aims to rank among leading countries in blockchain tech development . A successful crypto exchange would accelerate progress toward that goal, as it creates immediate use-cases and a whole industry around blockchain. We might anticipate Vietnamese universities partnering with companies to produce blockchain research, or the State Bank experimenting with a central bank digital currency that could interface with the crypto exchanges under certain conditions.

Inspirational note: Vietnam’s venture into the digital asset realm can also be seen through a larger lens – that of a nation rapidly modernizing and innovating while maintaining its own identity and control.

Just as Vietnam in previous decades transformed its economy through Đổi Mới reforms and global integration, today it is embracing the next frontier of technology. The image of Vietnam’s Prime Minister meeting with crypto executives from Korea, discussing legal frameworks and exchanges, would have been unimaginable a decade ago. It shows how far the mindset has shifted: from banning Bitcoin a few years back to now actively inviting crypto investment. This boldness to change course and adapt is a hallmark of Vietnam’s development story. It’s the same spirit that made Vietnam a manufacturing hub, and now a growing technology and startup center. With the digital asset market, Vietnam has identified an opportunity to leapfrog – to not just catch up to others in fintech, but potentially innovate new models.

In Southeast Asia’s competitive landscape, Vietnam’s move could also spur healthy competition. Countries may vie to attract blockchain talent and capital. Ultimately, this contributes to a more interconnected and innovative ASEAN region. Vietnam, with one of the largest and youngest populations in ASEAN, is poised to be a leader in this space if it stays the course.

=> Vietnam’s venture into digital assets in 2026 is both prudent and bold.

Prudent, because it is doing so with eyes wide open to risks – implementing pilot programs, involving established partners, and crafting laws for protection.

Bold, because it recognizes the immense potential and is not shying away from a cutting-edge field that many nations are still wary of.

The cooperation between MB and Dunamu encapsulates this spirit: a fusion of local and global strengths to create something new in Vietnam.

Comentários